The Price is Right… Or Is It? My 2025 Shopping Resolution

I’ll be honest — being frugal isn’t just about being cheap. It’s about survival, about knowing that every Rupee saved is a buffer against uncertainty. My wife calls it miserly; I call it being responsible. But deep down, I wonder: am I missing something?

The Constant Battle in My Shopping Cart

Every time I pick up a product, there’s this internal war. My brain starts calculating: Is this really worth it? Will this ₹2500 jacket serve me better than the ₹500 one? This is teh reason I do not still own a single Apple product, buying one just does not make any sense for me. My wife rolls her eyes, muttering about “you get what you pay for,†while I’m mentally tallying potential savings.

In the world of consumer behavior, the battle between “value for money†and “price equals quality†rages on. While some, like me, prioritize saving for a rainy day, others equate higher prices with superior quality. But what does the science say?

The Payless Experiment: A Masterclass in Perceived Value

In 2018, Payless ShoeSource orchestrated a marketing prank that would make even the savviest consumers question their purchasing decisions. By creating a fake luxury boutique called “Palessi,†they managed to sell their $20-$40 shoes for up to $645 to unsuspecting fashion influencers. This experiment brilliantly showcased the power of perception in shaping our buying behaviors.

The Psychology Behind the Price Tag

1. The Halo Effect

The Payless experiment demonstrates what psychologists call the “halo effect.†When we perceive something positively in one area (like a luxurious store environment), we tend to assume positive attributes in other areas (like product quality), even though it may not be true. This cognitive bias significantly influences our perception of a product’s value.

2. Social Proof and Influencer Impact

We now see first hand how the Page-3 fashion and the Instagram reels guides our wive’s behaviours, it’s the the power of social proof. We often look to others, especially those we consider experts, to guide our decisions. This tendency can lead us to value products based on others’ opinions rather than our own assessment.

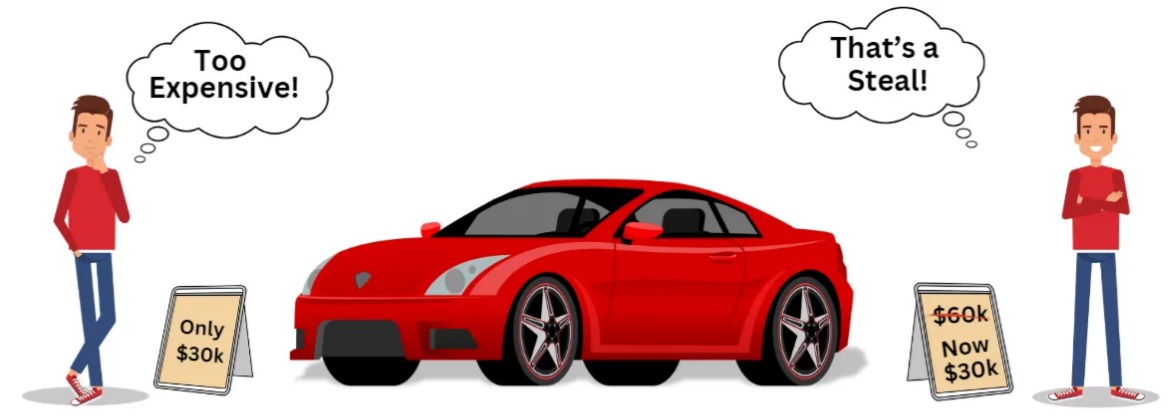

3. The Anchoring Effect

When we’re presented with a high price initially, it becomes an “anchor†in our minds. Subsequent prices are then evaluated in relation to this anchor. This weakness is effectively used by marketers. The cleverly placed higher priced items closed to cheaper ones on shelves; the “discount†offered on an inflated price; the “limited time†offer to create the FOMO, are all part of this strategy.

The Value-for-Money Perspective

If you are like me, who almost always prioritizes “value for moneyâ€, then our thoughts align with, what economists call, rational decision-making. This perspective assumes consumers evaluate the costs and benefits of each purchase, considering budget constraints and price sensitivity.

However, as the Payless experiment shows, human decision-making isn’t always rational. When we’re not motivated or able to make a decision carefully, we rely on mental shortcuts and emotional appeals. That fancy watch? It’s not just about telling time; it’s about how it makes you feel. That designer bag? It’s not just leather and stitching; it’s a statement.

The Price-Equals-Quality Belief

However, my wife’s perspective that “price defines quality†is not uncommon either. This belief is rooted in the idea that higher prices reflect better materials, craftsmanship, or exclusivity. While this can be true in some cases (like, I reluctanntly admit, in case of Apple devices), the Payless experiment proves it’s not always accurate.

Brands often appeal to our desire for status, belonging, or self-expression. This emotional connection can override rational considerations of price and value.

Marketing science and psychology experts recognize that while both “value-for-money†and “price-equals-quality†perspectives have merit, consumer behavior is far more complex than either view alone suggests.

Research shows that emotions play a significant role in purchasing decisions. Brands often appeal to our desire for status, belonging, or self-expression. This emotional connection can override rational considerations of price and value.

Branding expert David Aaker argues that perceived quality is more important than actual quality in many cases. Consumers make quality judgments based on various factors, including brand reputation, marketing messages, and even packaging (where again Apple excels).

The Payless experiment demonstrated how powerfully context can shape our perceptions. As Doug Cameron, Chief Creative Officer of the agency behind the prank, noted, “The right cultural codes can completely transform the perceived value of just about anythingâ€.

Finding Middle Ground

While the debate between “value for money†and “price equals quality†continues, the truth likely lies somewhere in the middle. Here are some mental notes for me to make informed purchasing decisions in 2025:

🔬Research is My Best Friend: Look beyond brand names and prices. Reviews, comparisons, long-term user experiences— I want to know everything.

😕Be Aware of Biases: Recognize that factors like store ambiance, brand reputation, and others’ opinions can influence my perception.

🪫Consider my Needs: Evaluate whether a higher-priced item truly offers benefits that justify the cost for my specific situation. Howeveer, I’ll not be cheap everywhere. For items that see heavy use — like shoes, I’m willing to invest. Comfort and durability have a price.

💞Balance Emotion and Logic: Acknowledge the emotional aspects of purchasing while also considering rational factors like budget and functionality.

🛒Emotional Budget: I would allocate a small “feel-good†fund. This allows my wife and me to occasionally splurge without guilt, keeping our financial peace.

â°The 24-Hour Rule: Impulse is the enemy of smart spending. I will give myself a day to think about any significant purchase. I am sure, half the time, the excitement would fade.

I do realize that while my “value for money†approach has merit, perceived value is a complex interplay of psychological, social, and economic factors. By understanding these influences, we all can make more informed decisions that balance our desire for quality with our need for financial prudence.

Whether we’re eyeing a pair of $30 shoes or their $645 “luxury†counterparts, the most important thing is that they fit our needs, budget, and values. However, it’s also okay to occasionally let go and enjoy a purchase that brings you joy. Afterall, life isn’t just about saving for a rainy day — it’s about occasionally dancing in the sunshine too.